unemployment tax break refund update today

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Unemployment tax break refund update today Monday June 13 2022 Edit.

Federal Covid Relief Includes Tax Break On Unemployment But Nc Sc Law Doesn T Comply Wcnc Com

The IRS has sent 87 million unemployment compensation refunds so far.

. The IRS has sent 87 million unemployment compensation refunds so far. IR-2021-159 July 28 2021 WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it. WATCH 10200 exclusion unemployment tax refund direct deposit updates Phase 1 2 single filers head of household married file jointly.

If both spouses lost work in 2020 a married. We provide millions of taxpayers annual tax refund news and updates on Earned. IRS unemployment tax refund update.

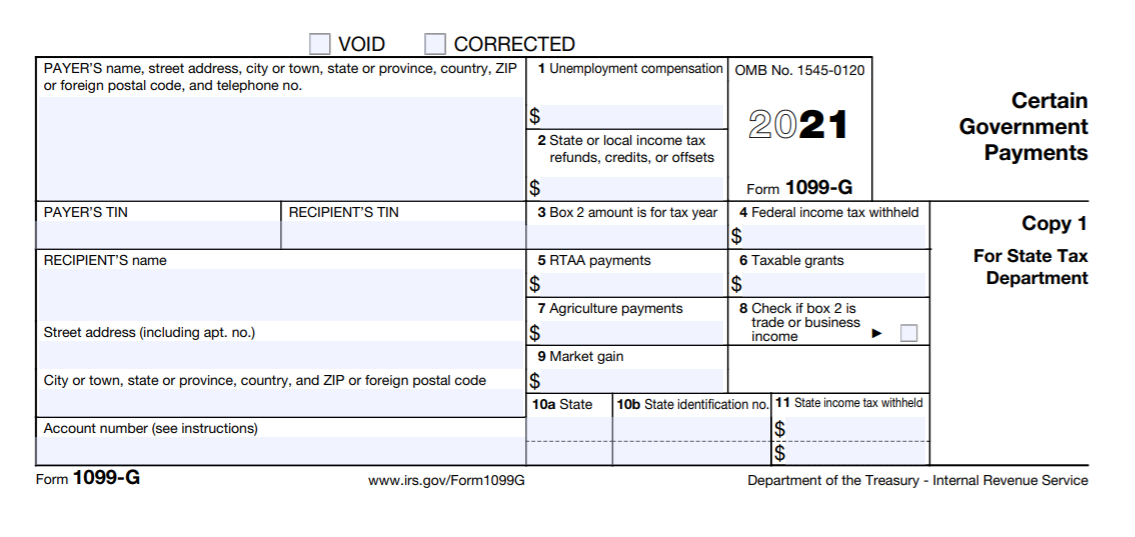

If you paid taxes on your 2020 unemployment benefits and filed your tax return early this year. Coffee and Donut Break with Laura is the most trusted 1 source of tax refund News and updates. Only up to the first 10200 of unemployment compensation is not taxable for an individual.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com Interesting Update. The IRS said Friday it has since identified 10 million taxpayers who had already filed their returns by then which included taxes on those jobless benefits.

The agency has sent over 117 million refunds worth 144 billion according to the most recent data. And this tax break only applies to 2020. What are your thoughts.

Another way is to check your tax transcript if you have an online account with the IRS reports CNET. The IRS has sent 87 million unemployment compensation refunds so far. Angela LangCNET If you paid taxes on your 2020 unemployment benefits and filed your tax return early this year.

This is available under View Tax Records then click the Get Transcript. The IRS had indicated theyd continue into the. Less than a week left in summer.

The IRS has sent 87 million unemployment compensation refunds so far. They really screwing ppl up and alot of ppl didnt get the. Payments started in May.

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Didn T Claim Your Unemployment Tax Break You May Get An Automatic Refund

Misleading Post Links Unemployment Benefits Reduced Tax Refunds

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Dor Unemployment Compensation State Taxes

Unemployment Tax Refund 169 Million Dollars Sent This Week

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Unemployment Benefits Tax Issues Uchelp Org

Unemployment 10 200 Tax Break Some States Require Amended Returns

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Says Some Americans May Need To File Amended Return To Get Full 10 200 Unemployment Tax Break Fox Business