tax benefit rules for trusts

Ad From Fisher Investments 40 years managing money and helping thousands of families. Assets in a revocable trust are included in the grantors gross estate for federal estate tax purposes.

The Generation Skipping Transfer Tax A Quick Guide

Most individuals dont use offshore asset protection trusts for their tax benefits.

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

. New Tax Rules for US. To control and protect family assets. In general the trust must pay income tax on any income its assets generate.

Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in. Tax rates can be high on income kept within a trust so it may be tax efficient to distribute most of the income but keep the principal within the trust. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in 2021 individuals do not reach this bracket until their taxable income.

In the case of trusts a deduction for amounts set aside for charitable contributions will only be allowed to trusts that are pooled income funds and only with respect to income. Namely the 50 CGT discount. You pay tax at the basic rate of 20.

One of the tax advantages of a family trust is related to Capital Gains Tax CGT. You may be able to claim tax back on trust income youve received if any of the following apply. Any distributions from a GST trust is subject to the 40.

As part of the trusts net income or net loss the trust has to. The good news is that the trust gets to deduct what it pays out. 9 1969 unless they are from an.

For an irrevocable trust to qualify for a charitable set-aside deduction in general 1 no assets may have been contributed to the trust after Oct. 260 plus 24 of the amount over. Is the trust.

When someone cannot handle their affairs. However a deduction against the higher tax rates at the trust level may yield the greater tax benefit. Ad From Fisher Investments 40 years managing money and helping thousands of families.

When someones too young to handle their affairs. For tax purposes OAPTs will be taxed as grantor trusts. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

For example if the trusts income consists. Revocable trusts also called living trusts are one of the more. You pay tax at the higher rate of 40.

But if the terms of the trust require it to pay out its income to a beneficiary then the trust itself is. As a result of the Tax Cuts and Jobs Act TCJA a non-resident alien NRA is now permitted to be a potential. Is the lessor of distribution to beneficiaries or estatetrust income Step 2 Income to Trust.

Treatment of trusts under Income Tax Act. If you transfer money or assets to another individual in excess of 14000 as of 2013 you may need to file a return. Trust income tax brackets are notoriously steep with a tax rate for 2010 of 35 starting when income reaches only 11200.

Trusts per se are not covered under definition of person us 231 however reference of trust can be found us. For trust expenses such as trustee fees and tax return preparer fees only the portion attributable to taxable income is deductible. 0 to 2600 in income.

Below are the 2020 tax brackets for trusts that pay their own taxes. Offshore trusts are not tax shelters. However it should be noted that Congress enacted a generation-skipping GST tax to close this loophole that families discovered.

10 of taxable income. State tax refunds are only SOMETIMES taxable on the 1040. Trusts are set up for a number of reasons including.

Trusts also can be. General Rule Who Pays the Tax on EstateTrust Step 1 Income to Beneficiaries. 2022 Long-Term Capital Gains Trust Tax Rates.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. This means that you. By the federal tax code gift tax applies only to individuals not to trusts.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. In Example 1 the tax benefit of the QBI deduction at the trust. 2601 to 9450 in income.

Pin By Debbie Wolfe On Trusts Estate Tax Tax Return

Trust Registration Service 2020 Trust Tax Rules Online Trust

Cbdt Condones Of Delay In The Filing Of Form 10bb By Trusts And Institutions Institution Taxact Tax Rules

Jk Lasser S New Rules For Estate Retirement And Tax Planning Ebook By Stewart H Welch Iii Rakuten Kobo Free Books Online Books To Read How To Plan

The Generation Skipping Transfer Tax A Quick Guide

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

Funding Your Revocable Living Trust Handler Levine Llc Revocable Living Trust Living Trust Estate Planning Checklist

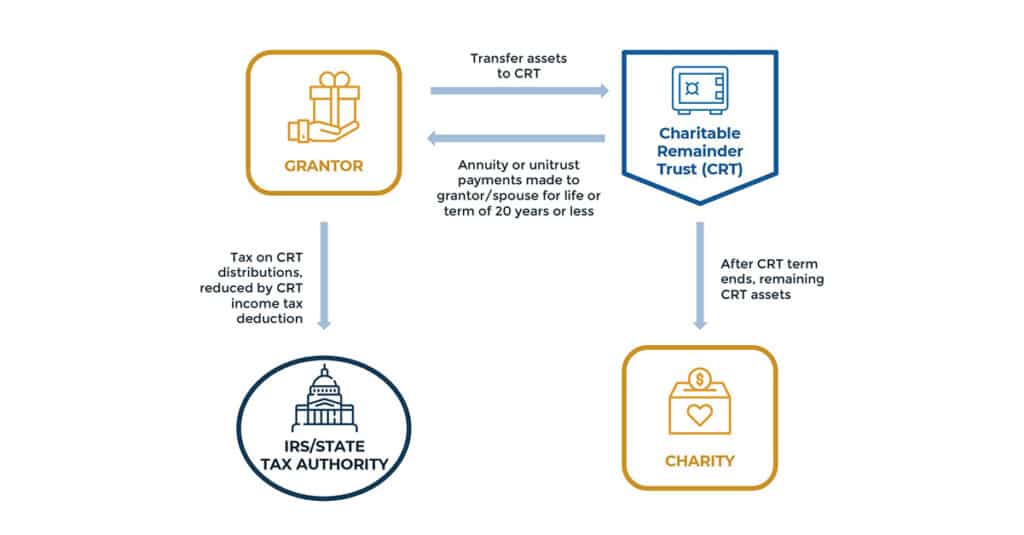

Charitable Remainder Trusts Crts Wealthspire

How To Get A Self Employed Mortgage Bookkeeping Business Self Mortgage

Distributable Net Income Tax Rules For Bypass Trusts

Distributable Net Income Tax Rules For Bypass Trusts

Pin En End Of Life Management Tools

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Exploring The Estate Tax Part 2 Journal Of Accountancy

All You Need To Know About Institutional Donors In Your Fundraising Strategy For Your Non Profit Proposa Fundraising Strategies Grant Writing Proposal Writing

What Is A Step Up In Basis Cost Basis Of Inherited Assets

How To Find The Top Lawyers Specializing In Wills Near Me Good Lawyers Lawyer Law Office

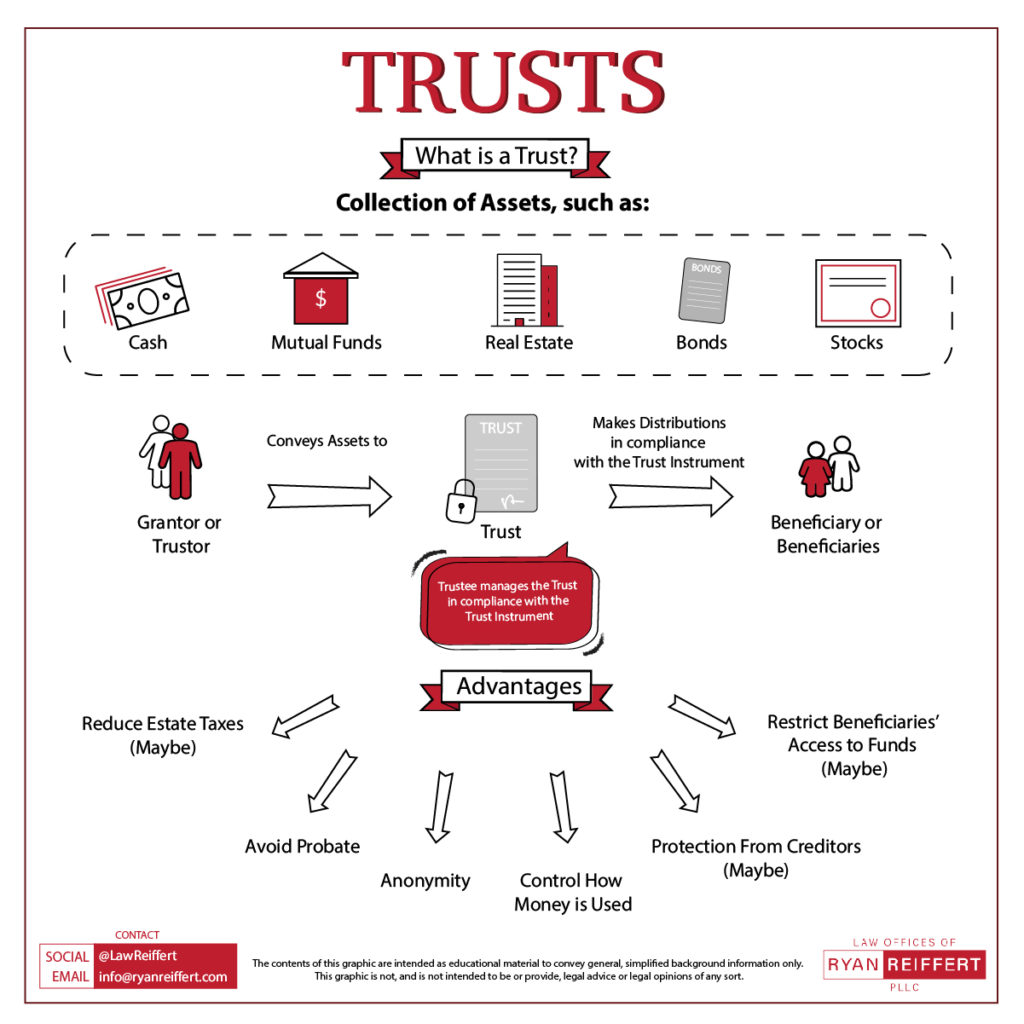

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

Pin By Debbie Wolfe On Trusts Sell My House Estate Tax Trust